Contact us

Contact us

This is a version of the original article published by CERISE + SPTF.

Advans believes that financial inclusion can only deliver on its promise of empowerment for entrepreneurs and farmers if financial services are delivered ethically, transparently, and respectfully to all clients. As an international group of microfinance working in six markets in Africa, Advans has the ambition to ensure that all its subsidiaries are applying the highest standards in Client Protection through aiming to get 100% of its network certified. This commitment strengthens its role among supporting responsible growth and SME financing in Africa.

At the beginning of 2025, Advans Tunisie and Advans Cote d’Ivoire were the first two subsidiaries within our group of MFIS in Africa to receive client protection certification: Advans Cote d’Ivoire received silver level certification while Advans Tunisie received gold level certification from leading rating agency MFR. These two institutions, which serve 280,000 clients and have a combined loan portfolio of over 200 million Euros, join the first institutions in Africa to be certified with the new client protection standards. This is a major step for both institutions, and for the group as a whole, as it continues to pursue its mission to deliver responsible and sustainable financial services to drive growth for African entrepreneurs and farmers.

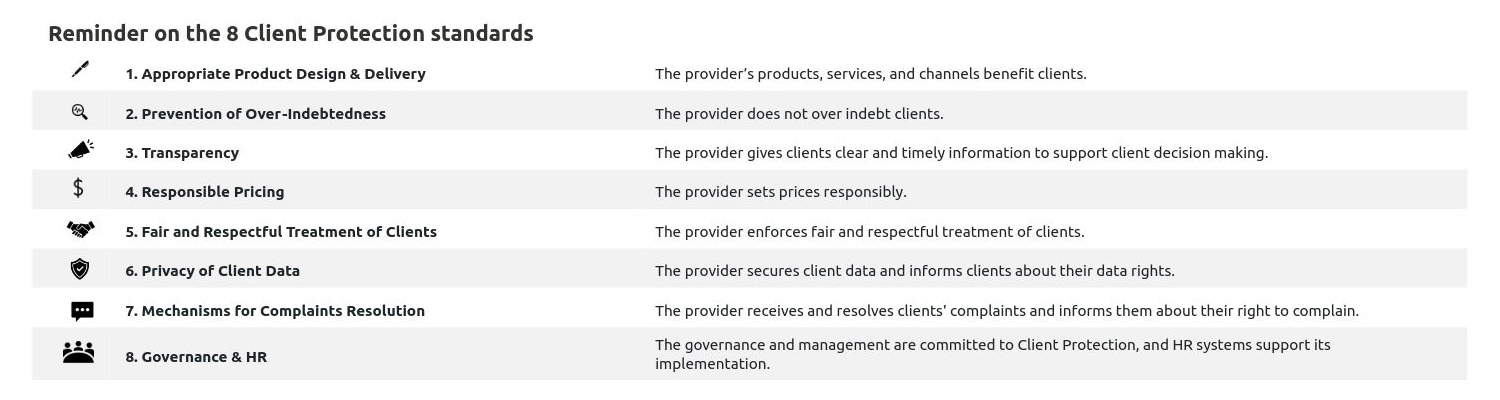

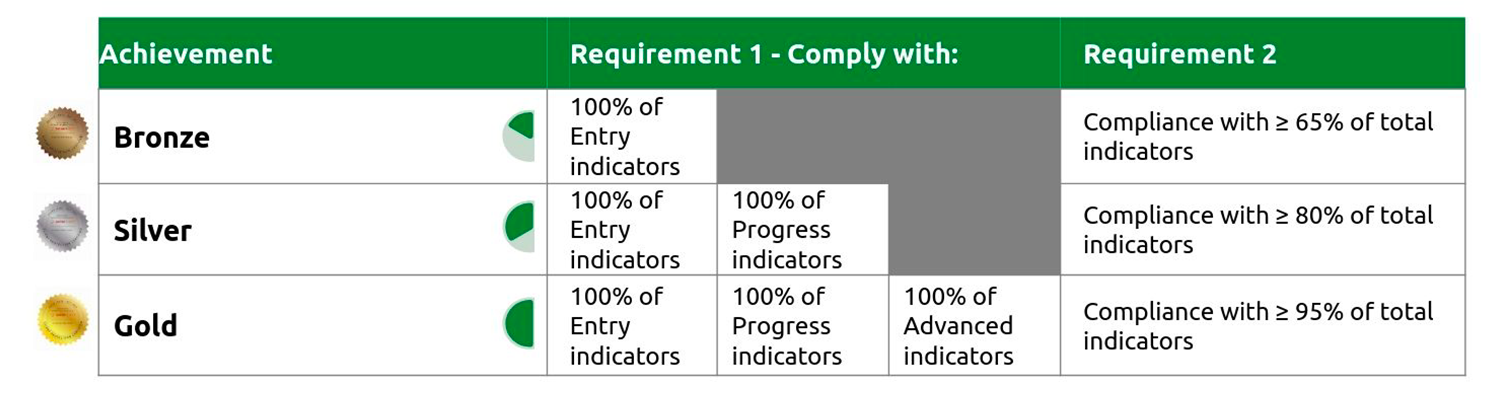

Client Protection certification means that a Financial Services Provider (FSP) has been audited by a third party to verify its application of the client protection principles listed above and their integration in the FSP’s policies, processes and practices. There are 128 indicators to apply, 78 of which are split into Entry, Progress and Advanced indicators, the full list can be discovered here. Certification is given if an FSP meets the requirements below:

Advans always endorsed the Client Protection Standards and has been using SPI Online assessment tools (Social Performance Indicators) to assess its practices in Social Performance for the past ten years, but these latest certifications are a result of a concerted effort by the group of MFIs in Africa to reinforce client protection practices across the network and bring all subsidiaries up to the same level. Starting in 2022 after the publication of the new Client Protection Standards, Advans, as a signatory of the joint statement, began to work on ensuring that there was a harmonized approach to client protection in its group model. The main steps in the strategy were:

-Identifying gaps in the Advans model and subsidiary practices compared to the new standards through:

Reviewing group model policies, trainings and processes;

Conducting self-assessment audits in three pilot markets – Cote d’Ivoire, Ghana (CP indicators in the SPI5 Full) and Tunisia (CP Full) , with results shared with management and the Board of Directors;

Using client feedback from the 60 Decibels microfinance index (conducted across the network in 2021-2022 and 2024) to identify weaknesses in our services from a client perspective.

-Integrating or strengthening the mention of client protection standards in all policies and processes at group and subsidiary level, including for example the Claims Policy, the Code of Ethics, the Data Protection Policy, and many more.

-Reinforcing training and awareness around Client Protection Standards generally, and on specific topics such as Transparency and the Claims Policy or reminders on the Code of Ethics.

-Defining an action plan for each subsidiary to ensure they conform to the maximum number of Client Protection standards.

-Applying for certification with an external body once subsidiaries are confident that they are applying the standards sufficiently.

Now that the Advans Group has achieved the milestone of its first certifications, it is looking to ensure that its other MFIs in Africa can follow suit. The group will continue to work to make sure all its subsidiaries are eligible for certification, with the aim of having 100% of the group certified in the near future. Of course, Advans also knows that certification is not the end of the line; Advans will continue to monitor and improve its enforcement of client protection standards in the years to come, showing its commitment to maintaining a relationship of trust with its clients and to accelerating responsible financial inclusion in Africa.

CERISE + SPTF

Cerise+SPTF is a joint venture focused on social and environmental performance management. It develops standards and tools for financial service providers, promoting responsible finance and customer protection. Their work has empowered thousands of stakeholders in the inclusive finance sector to improve practices for people and the planet