Contact us

Contact us

Between September and October 2024, Advans Tunisia conducted a second survey in partnership with 60_decibels to assess the impact of its services on farmer customers. Carried out with the support of SCBF, the study gathered responses from 280 participants, 5% of whom were women. .

Farmers have been able to increase their income and improve their quality of life thanks to Advans

Advans Tunisie’s agricultural loans have a proven impact on the growth of the agricultural activities they finance. 80% of farmers surveyed have increased their income since joining Advans, 37% of them significantly. Among clients who have been able to increase their income, 39% have increased the number of livestock and 20% have been able to invest in new land. Advans Tunisie also has a strong impact on the quality of life of the farmers it finances, with 70% of its farmer clients reporting an improved quality of life. This improvement mainly translates into better access to healthcare (39% increased their spending, including 14% by a lot) and education for their children (43% increased their spending). By facilitating access to financial services tailored to farmers’ specific needs, Advans contributes to improving their general well-being, while supporting their personal and professional development.

Advans Tunisie also has a strong impact on farmers’ climate resilience

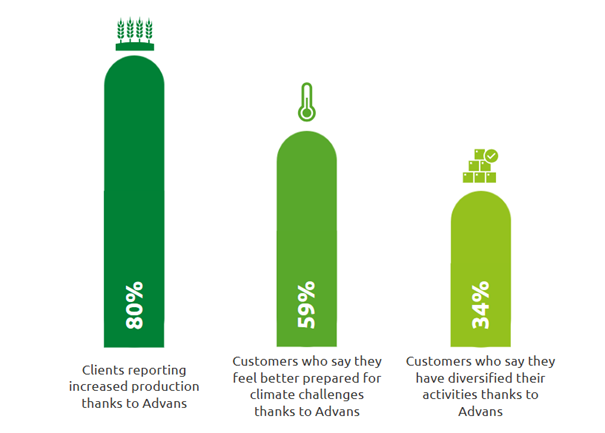

Tunisian farmers are often faced with major challenges linked to the seasonal nature of their business and climate variability. Our loans enable them not only to increase their production, with 83% of farmers reporting a noticeable improvement (42% with a significant improvement), but also to diversify, with 34% of customers having been able to diversify their farming activities thanks to the loan. This diversification, which can involve the planting of new crops (23%), planting trees (7%) or buying livestock (4%), is essential to strengthening farmers’ resilience in the face of difficult climatic conditions and unforeseen events, offering them diverse sources of income and increased ability to cope with market fluctuations. These efforts are part of a wider movement to improve financing climate change adaptation across the continent. Indeed, 59% of farmers surveyed said they felt better prepared for climate challenges thanks to Advans. Some customers, for example, were able to find fodder storage solutions for their livestock (33%) or invest in irrigation systems (30%). This ability to adapt is crucial, given that today, 28% of Advans Tunisie’s customers are vulnerable to climate change, most of them in the agricultural sector.

Advans will continue to support farmers with flexible products

The study showed that the flexible repayment schedule offered to farmers at Advans Tunisia is highly appreciated by customers and that impact is higher for customers who benefit from this system. 50% of farmers with a flexible repayment schedule said that their ability to repay their credit had greatly improved, and 35% said that it had improved. This shows the importance of offering solutions tailored specifically to farmers’ needs. Product adaptation will become increasingly important as vulnerability to climatic hazards increases, jeopardizing the stability of farmers’ incomes. Advans Tunisia’s ambitious climate strategy aims to better serve farmers and help them find solutions to better anticipate and manage climate risks, to secure their activity over the long term. The company is currently working on the introduction of green products and the development of awareness-raising campaigns for this target group. This approach is fully in line with the Advans Group’s ambition to develop sustainable solutions to support agriculture, which is an essential sector for a sustainable future, and finance climate change adaptation, while responding to the growing challenges facing the sectors.

To learn more, discover how Advans promotes the highest standards in customer protection.

SCBF supported the 60_decibels impact study on farmers in Tunisia. SCBF was launched in April 2011 as a public-private platform between the Swiss private sector and the Swiss Agency for Development and Cooperation (SDC) to promote financial inclusion in developing and emerging economies. Agriculture is a key pillar of the SCBF strategy, which aims to: enable equitable access to agricultural financing solutions, markets and resources; strengthen stakeholders in the agricultural ecosystem to be more resilient to climate shocks and promote the adoption of resilient agricultural practices (SDG 13 – Climate action).

60_decibels is a specialist in social impact measurement. 60_decibels helps companies, investors and organizations to assess and understand the real impact of their initiatives by gathering direct feedback from beneficiaries and stakeholders.

The 2024 Microfinance Index (MFI Index) is an impact study on financial inclusion, based on data from 126 financial service providers and supported by 27 partners. It is based on the analysis of feedback from over 36,000 customers of international microfinance institutions in 45 countries, representing 32 million people. The index measures six key dimensions: access to financial services, impact on businesses and households, client protection, resilience to risk and beneficiary autonomy.