Contact us

Contact us

Advans Tunisie participated in the 60_Decibels microfinance index with a study focusing on gender issues for 3 key microfinance players in Tunisia. Commissioned by Proparco, Advans Group’s long-standing partner, the study gathered feedback from 301 customers, 58% of whom were women.

Advans Tunisie has a positive impact on both business growth and women’s quality of life

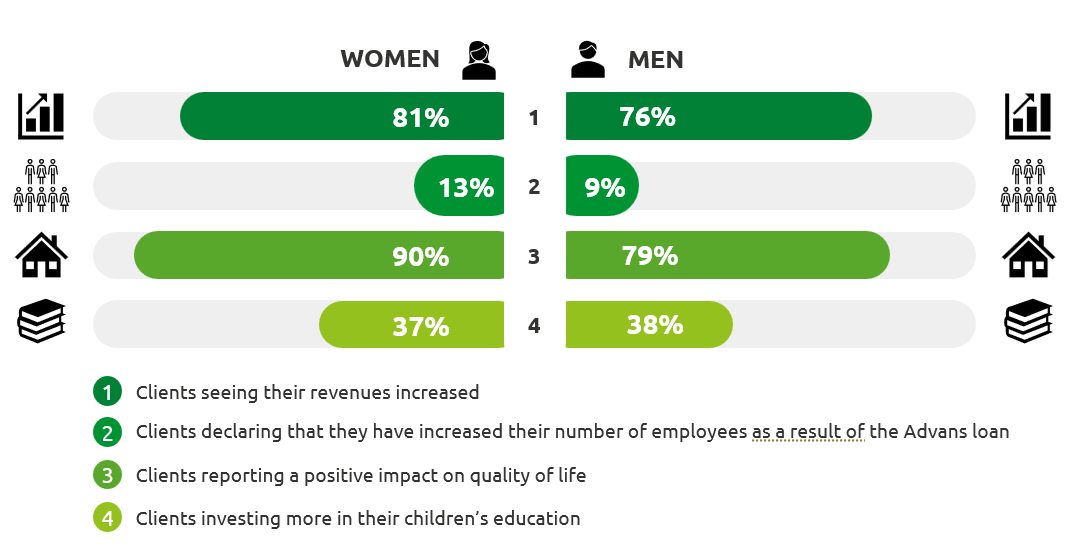

Advans Tunisia’s financial services have a clear impact on women’s economic empowerment and business growth. 82% of female customers surveyed saw their income increase (versus 61% of men), with 25% noting a significant increase. 13% were able to create new jobs (versus 9% of men). Advans Tunisie also contributes to a clear improvement in quality of life, with 90% of female customers in the study saying that their quality of life had improved (versus 80% of men), with 33% saying it had improved a lot. This is reflected in a greater ability to invest in their children’s education: 39% of women devote more resources to education since joining Advans (versus 23% of men). While at Advans Group level, impact is often more marked on quality of life versus business for women, Tunisia is an exception: the positive effects of Advans services are stronger for women than for men, both economically and socially. This demonstrates the importance of access to appropriate financial services with microfinance for women in Tunisia.

The services provided by Advans Tunisie also have a significant impact on women’s economic resilience.

Thanks to Advans’ financial services, women clients have also been able to improve their financial management and gain in confidence. Today, 75% of female customers say they have improved their financial management, including 29% who have greatly improved this aspect, vs. 21% of men who have greatly improved. 22% say their ability to make financial decisions has improved significantly. What’s more, 76% of women say that Advans’ support has increased their ability to achieve their financial goals, with 36% saying that it has significantly increased their ability. 58% of female customers surveyed say that their self-confidence has greatly increased, and 40% say that they now make more financial decisions independently. These improvements show the clear impact of Advans Tunisie’s support in helping female entrepreneurs overcome economic and social challenges and also could explain why overall satisfaction with Advans Tunisie is higher among women.

Did you know? According to the World Bank’s GlobalFindex2021 there is a 16% gap between men and women in Tunisia regarding access to bank acounts, with only 29% of women having access to traditional finance compared to 45% men.

According to the Tunisian Microfinance Supervisory Authority, 56% of microfinance institution (MFI) clients in Tunisia are women. However, these female clients account for only 45% of the total granted, meaning that the average loan size for women is lower than that of men.

Advans continues to work to improve access to financial services for women

Nevertheless, the study shows that Advans can go further to improve its services for women. In particular, the institution needs to work on increasing the transparency of terms and conditions for this target group and better communicate on how to make a complaint in the event of a problem. It goes without saying that gender inequalities remain an obstacle to economic independence, with access to financial services still limited for many women, especially in remote areas of Tunisia. Advans Tunisia is already working to facilitate access for these populations, and in 2023 launched the El Beya loan, a product dedicated to microfinance for women that aims to give them greater flexibility in terms of guarantees required and free borrower insurance. As at end March 2025 this product has an outstanding portfolio of 11.98 million dinars, equivalent to 3.5 million euros. The institution has also organized awareness-raising workshops with industry players to reflect on the barriers to financial inclusion for Tunisian women and on the potential levers to better serve them. These initiatives are in line with the Advans Group’s ambition to accelerate financial inclusion for women in all its countries of operation, and to strengthen women’s capacity for entrepreneurship and development with a tailored product offering.

Proparco, supported the 60_decibels impact study on women entrepreneurs in Tunisia. Proparco, the private sector arm of the Agence Française de Développement (AFD Group), has been working for 45 years to promote sustainable economic, social and environmental development. Reducing gender inequalities and promoting women’s empowerment are at the heart of Proparco’s 2023-2027 strategy, in line with the AFD’s commitment to SDG 5 – Gender equality. Find out more about their gender impact report for Tunisia.

60_decibels is a specialist in social impact measurement. 60_decibels helps companies, investors and organizations to assess and understand the real impact of their initiatives by gathering direct feedback from beneficiaries and stakeholders.

The 2024 Microfinance Index (MFI Index) is an impact study on financial inclusion, based on data from 126 financial service providers and supported by 27 partners. It is based on the analysis of feedback from over 36,000 customers of international microfinance institutions in 45 countries, representing 32 million people. The index measures six key dimensions: access to financial services, impact on businesses and households, client protection, resilience to risk and beneficiary autonomy. s.